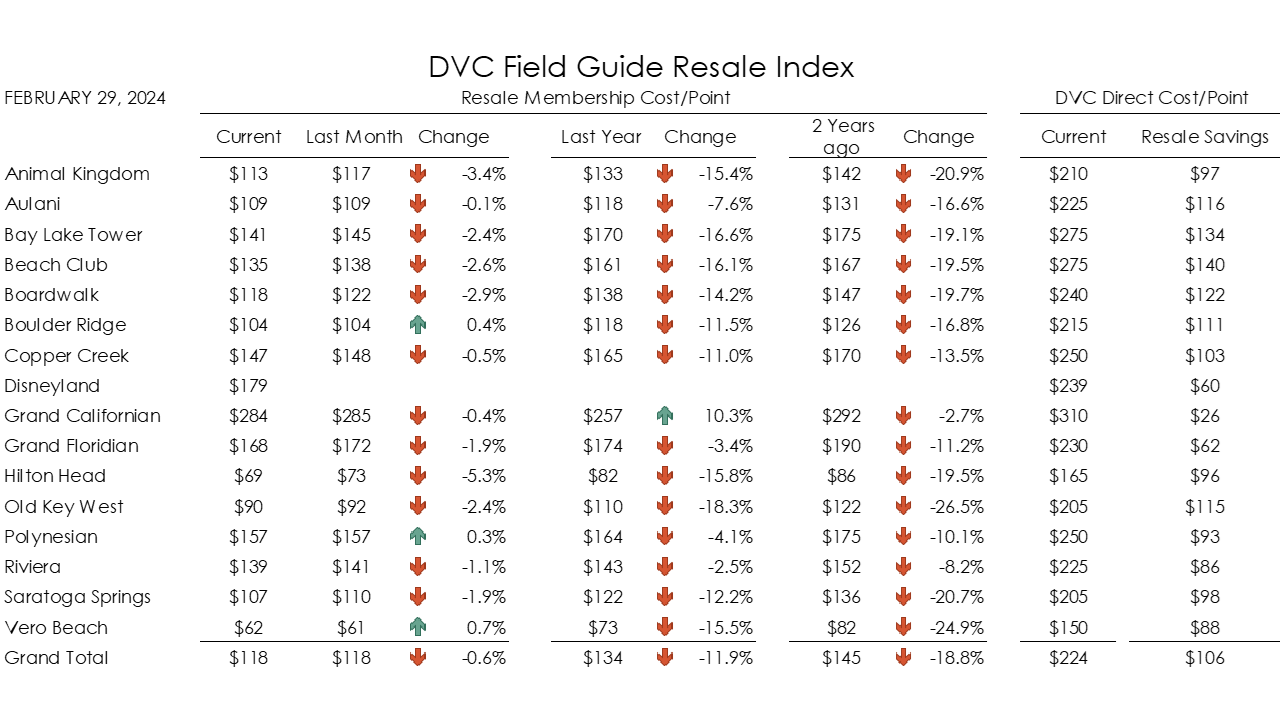

DVC FIELD GUIDE RESALE INDEX (a snapshot of DVC resale listings at three top resellers) was slightly lower at 0.6% compared to last month. The average price/point on the resale market was $118.35 in January, dropping to $117.67 in February. A year ago, the price resale index was $133.62, an 11.9% drop. Two years ago, the index was at $144.98, an 18.8% drop.

Despite the price drops Year-Over-Year, resale pricing can still provide DVC members with considerable savings over direct pricing from Disney. Direct pricing averages $223.89. Resale savings range from $26- $140 per point. Beach Club, Bay Lake Tower, and Boardwalk provide the most significant savings.

The second table compares the "total" cost of a resort annually. A resort may have a low initial cost but a high annual dues cost. A simple economic valuation considers the initial purchase price and annual dues cost. The analysis is calculated by taking the initial contract's current cost and dividing it by the remaining years on the DVC contract to give some value to DVC resorts with longer contract end dates. The amount represents the initial purchase's annual cost, and by adding the current yearly dues cost/point, you get an average annual value comparable to other resorts. For February, the most economical resorts for a RESALE purchase are Copper Creek ($11.44/point) and Bay Lake Tower ($11.53/point). Vero Beach ($17.30/point) and Grand Californian ($16.45/point) are the least economical. For a DIRECT DISNEY purchase, the best resort is Grand Floridian ($13.33/point), with Beach Club being the worst ($23.96/point)

The DVC Field Guide Resale Index is a snapshot of DVC resale listings at three top resellers (DVC Reale Market, Fidelity, Timeshare Store)

https://www.dvcfieldguide.com/